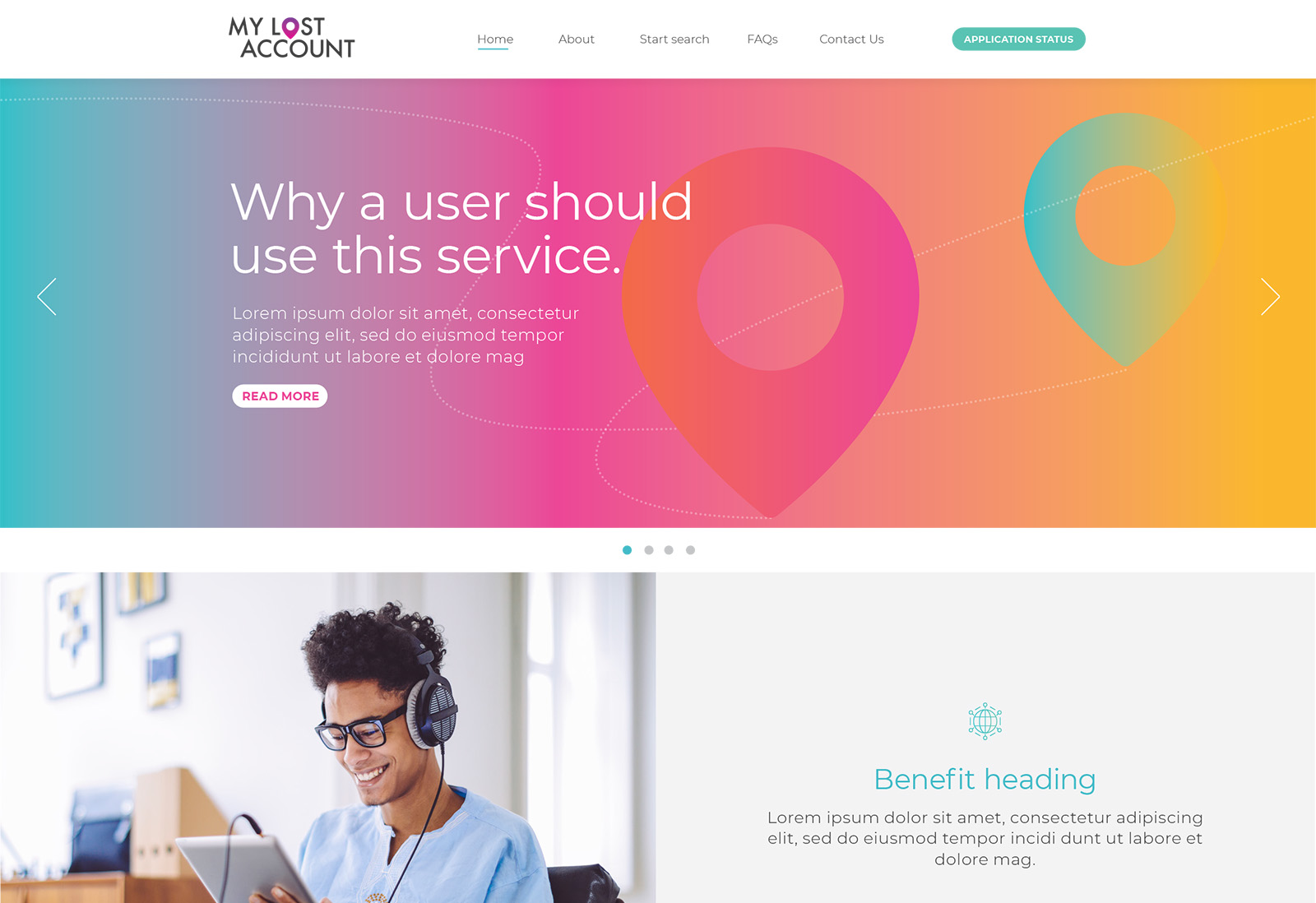

A secure, responsive web portal connecting UK consumers with dormant financial accounts across multiple banking institutions.

What we did

- Full-stack web application development

- Custom ExpressionEngine CMS implementation

- Responsive UI/UX development from Bladonmore designs

- Secure database architecture and management

- Financial data import/export functionality

- Automated transactional email integration

- SFTP secure data transfer protocols

- Comprehensive quality assurance and cross-device testing

About the project

My Lost Account is a vital digital service within the UK financial sector, designed to help individuals rediscover lost or dormant bank and building society accounts. When the project was initiated, the primary goal was to create a central, trusted hub where users could securely submit search requests that would then be processed by various financial institutions. Our role at Tinderhouse was to take the conceptual designs and turn them into a high-performance, secure, and accessible reality.

Because of the sensitive nature of financial data and the need for immediate user trust, we prioritised a robust minimum viable product strategy to ensure the core search and verification features were flawless before scaling. This MVP development approach allowed us to focus on the essential user journey: account registration, secure search submission, and the complex back-end logic required for bank staff to manage these applications. By launching with a refined feature set, we ensured the platform could handle high traffic volumes without compromising security or data integrity.

The project required a deep level of collaboration. We worked closely with the design agency Bladonmore to implement their templates with pixel-perfect precision. Our web development team focused on building a system that was not only visually aligned with the brand but also technically capable of handling the rigorous demands of the UK banking industry. The result is a seamless, professional interface that guides users through a potentially confusing process with ease and clarity.

The Challenge

Developing a platform like My Lost Account presented several significant hurdles that required expert technical oversight. The primary challenge was the sensitive nature of the information being handled. We had to ensure that every search request, which contains personal and financial identifiers, was stored and transmitted with the highest levels of security. There was no room for error regarding data privacy or server-side vulnerabilities.

Beyond security, the platform had to cater to two very different user groups. On one side, we had the general public, ranging from tech-savvy millennials to older generations who might be less comfortable with digital forms. This necessitated a heavy focus on accessibility and a simplified, paginated search process. On the other side, we had bank staff members who needed efficient tools to process thousands of applications. Their pain points included:

- The lack of a centralised dashboard to track application statuses.

- Inefficient manual data entry and the need for bulk import/export capabilities.

- The requirement for secure, automated communication with the National Savings and Investments (NS&I) systems.

- Ensuring the site performed perfectly on everything from legacy office desktops to modern mobile devices.

- Managing an audit log that could track every action for compliance and security purposes.

Our Solution

To address these challenges, we built a bespoke system using a combination of proven technologies and smart architectural choices. Our solution focused on security, ease of use, and administrative efficiency.

Robust CMS and Content Management

We chose to use our expertise as ExpressionEngine specialists to provide a robust, enterprise-capable content management system. This choice was deliberate, as ExpressionEngine offers exceptional security and flexibility for custom data channels. We configured the CMS to act as the central data hub, allowing administrative staff to manage static content and user accounts without needing technical knowledge. This separation of content and code ensures the platform remains easy to update while maintaining a secure core.

Streamlined User Experience

For the front-end, we implemented a responsive layout that adapts to any screen size, with a maximum width of 1366 pixels to suit desktop users while providing specific breakpoints for tablets and mobiles. The search form itself was built with a paginated structure, allowing users to navigate back and forth to edit their details without losing data. We integrated field validation and accessibility tools to ensure that the form was usable for everyone, regardless of their technical ability or the device they were using.

Advanced Banking Tools

The back-end of the portal was designed to be a powerhouse for bank staff. We developed a dedicated dashboard where staff could view applications, update statuses, and add sort codes. A key feature was the import/export functionality, allowing staff to handle data via CSV files, which significantly reduced the time spent on manual updates. For the NS&I integration, we implemented a secure SFTP protocol that automatically saves search data to the server, ready for retrieval, ensuring a smooth flow of information between different financial bodies.

Security and Communication

Security was woven into every layer of the build. The entire site operates under HTTPS, and we implemented a comprehensive audit log within the CMS to track all user and bank actions. To handle communications, we integrated third-party services like Mandrill for transactional emails. This ensured that welcome messages, password resets, and status notifications were delivered reliably and securely without containing any sensitive personal information in the email body itself. This approach to financial sector digital solutions ensures compliance with strict data protection standards.

The Results

The launch of the My Lost Account portal marked a significant improvement in how dormant accounts are recovered in the UK. By moving to a more automated and secure web-based system, the process became faster for both the consumer and the financial institutions.

- Successfully reconnected thousands of users with lost assets through a streamlined search process.

- Drastically reduced administrative overhead for participating banks through the CSV import/export and dashboard features.

- Maintained 100% data integrity and security through rigorous HTTPS and SFTP protocols.

- Achieved high user satisfaction scores due to the accessible, mobile-responsive design.

- Provided a transparent and auditable trail for all financial search requests, satisfying internal compliance requirements.

- Established a scalable platform that continues to serve as a primary resource for the UK banking industry.

Technical Highlights

Our team used a specific stack to ensure longevity and performance for this 2017 build:

Server-side: PHP 5 framework for robust logic and data processing.

Database: MySQL for secure and scalable relational data storage.

CMS: ExpressionEngine for enterprise-level content and user management.

Front-end: HTML5 and CSS 3.0 to ensure wide-reaching cross-browser support, including legacy systems.

JavaScript: Used for enhanced form functionality and interactive elements.

Integrations: Mandrill for transactional email delivery and SFTP for secure data transfers.

Analytics: Customised Google Analytics integration to track user behaviour while filtering internal agency traffic.

Build Your Financial Portal

Looking to develop a secure, high-traffic web platform or financial tool? Our Kent-based team specialises in creating robust digital solutions that bridge the gap between complex data and user-friendly interfaces.